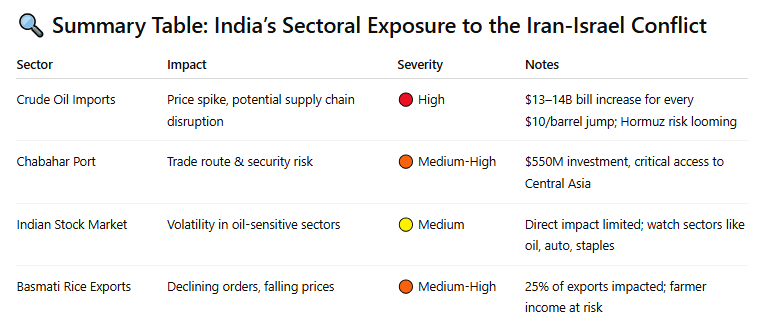

In this edition, we dissect the multi-dimensional impact of the conflict on India, from rising oil bills and basmati export losses to potential disruption in strategic trade routes and digital infrastructure. Here's what you need to know — backed by the latest data and expert insights.

India imports over 85% of its crude oil, making it deeply sensitive to global price fluctuations. Since the conflict began, Brent crude prices have surged from $64/barrel in May to $75/barrel by mid-June. (Source: The Hindu)

For every $10/barrel increase, India’s oil import bill could rise by $13–14 billion, widening the current account deficit by 0.3% of GDP

For every $10 per barrel increase in crude oil prices, India’s oil import bill could rise by approximately ₹1.08 to ₹1.17 lakh crore, potentially widening the current account deficit by 0.3% of the GDP.

Livemint also warned that not just prices that worry policymakers. Nearly 45–50% of India’s oil imports pass through the Strait of Hormuz, a narrow chokepoint now under threat. A full-blown naval blockade or attack here could send oil prices soaring above $100/barrel.

📉 This would reverse India’s recent monetary momentum. With inflation cooling to 2.82% in May 2025 and the RBI cutting interest rates by 50 basis points, there was room for optimism. But that room is shrinking.

Chabahar Port: India’s Strategic Gateway

India’s ₹4,575 crore (approx. $550 million) investment in Iran’s Chabahar Port is not just a commercial venture — it’s a strategic move to bypass Pakistan and access Central Asian markets.

In May 2024, India secured a 10-year operational contract for the Shahid-Behesti terminal.

Chabahar is a vital link in the International North-South Transport Corridor (INSTC), connecting India to Afghanistan, Russia, and Europe.

However, the ongoing regional conflict raises serious concerns.

🛑 Any escalation near the Iranian coastline could disrupt port operations, put India’s significant investment at risk, and hinder critical trade connectivity, according to The Telegraph India.

Adding to the complexity, India’s cautious diplomatic approach — including its refusal to join the Shanghai Cooperation Organisation’s condemnation of Israel — may strain ties with Iran. If relations deteriorate, the future of Chabahar could be in jeopardy.

Indian Stock Markets: Holding Steady… But how long ?

Despite fears, Indian equity markets have shown surprising resilience. The Nifty 50 and BSE Sensex have remained largely range-bound since the conflict began.

However, sectoral tremors are visible:

🛢️ Oil marketing companies face margin pressures from high input costs.

🚗 Auto manufacturers may experience cost hikes due to oil-linked transportation and logistics expenses.

🧴 Consumer staples companies risk inflation in packaging and FMCG distribution.

💊 Pharma and chemical firms could see rising raw material prices.

⚠️ Analysts at Emkay Global warn that sustained high oil prices could stall market rallies and force institutional rebalancing.

Basmati Rice Exports: The Farmers Feel It First

Iran is India’s largest buyer of basmati rice, accounting for about 25% of total exports. But geopolitical tension is already biting.

Iran had already banned basmati imports from Oct–Dec 2024 to protect its domestic crop.

The current conflict has worsened the situation, with reduced orders, shipping delays, and insurance companies withdrawing coverage.

As a result, prices of premium basmati rice have dropped, hitting farmers in Punjab and Haryana the hardest (The Hindu, Business Standard).

Exporters now face the dual challenge of inventory pile-up and loss of earnings — and are urging government intervention before sowing decisions are affected.

Strategic Outlook: What Should India Do Next?

1. Strategic Oil Reserves: Expand storage capacity and diversify sourcing toward Latin America, Russia, and West Africa.

2. Trade Diversification: Accelerate FTAs and trade linkages with Central Asia via alternate corridors (like the Ashgabat Agreement, or even through Russia's Arctic route).

3. Chabahar Shielding: Engage Iran and regional partners diplomatically to ensure operational continuity, possibly with third-party security partnerships.

4. Fiscal Buffering: Anticipate oil-linked subsidy increases and prepare a special buffer in the Union Budget 2026.

5. Digital Risk Monitoring: Treat internet infrastructure as critical national security asset; invest in redundancy and monitoring systems for undersea cables.

#IndiaGeopolitics #IranIsraelConflict #OilPrices #ChabaharPort #BasmatiRiceExports #UnderseaCables #IndianEconomy #Newsletter #EnergySecurity #June2025